November is National Alzheimer’s Disease Awareness Month and in an effort to fight this debilitating disease that affects an estimated 5.7 million Americans, Chaffin Luhana LLP team members, Danielle Leppar, Francesca Clements, and Dan Reo interviewed Max Tokarsky, the Founder and CEO of InvestAcure.

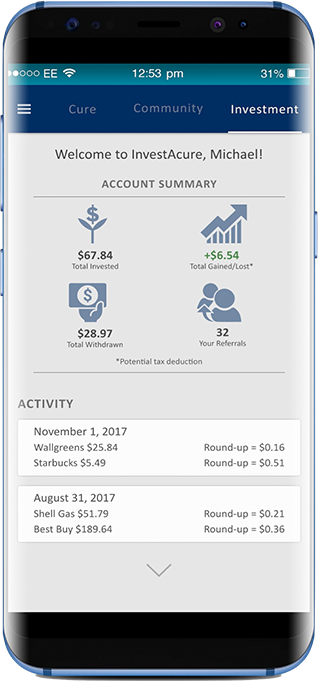

The InvestAcure app implements spare-change investing for individuals to provide financial support for companies researching a cure to Alzheimer’s disease.

What inspired you to create InvestAcure?

About five years ago, my daughter was diagnosed with osteosarcoma, a rare childhood cancer. It was a shocking, horrible moment.

Like any parent would, I begin to seek out medical interventions and drugs in development. I found a drug that statistically reduced the risk of osteosarcoma recurrence by up to 50%.

That drug was being developed by a tiny company, and it was discontinued. They did not go forward with the final clinical trial that they needed to do because it didn’t make financial sense.

It would have cost $140 million, and they calculated that they could not make that money back. As a result, we actually had to purchase the drug out of the country for $100,000.

That experience left me incredibly perplexed. What is the ecosystem where this life-saving cure is being spearheaded by a tiny company nobody’s ever heard of, where finances play such a disproportionate role on a life-and-death issue?

When I began to research this topic, I discovered a fascinating dysfunction in the modern drug discovery. Governments and charities support what’s called basic research, which focuses on understanding the underlying mechanisms of various diseases.

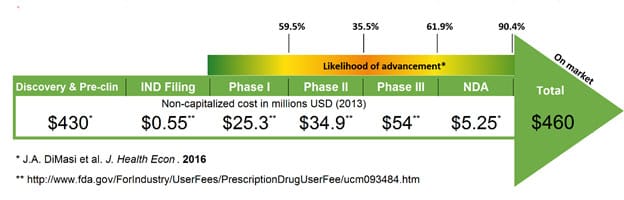

Once a discovery is made on a basic level, we depend on private companies to invest millions of dollars in developing a drug. They spend hundreds of millions of dollars in the hopes that they will make all that money back when they develop a successful drug and sell it to consumers.

So the assumption is that, once these scientists who are working on basic research come up with a brilliant way to cure mice of cancer or Alzheimer’s, then the pharmaceutical industry would take it from there

The problem is that, increasingly, this process of investing to turn science into cure has become not very profitable for the pharmaceutical industry.

In fact, the cost of developing a drug doubles every nine years. So today it costs 80 times more to develop a single drug than it did in 1950.

This means that taking a good idea and exploring how to turn it into a cure is a very risky investment. Let’s take a field like Alzheimer’s, where there hasn’t been a drug approved in fifteen years. You have a 99.6% chance of any idea failing.

Imagine if I told you, “I have an investment for you. You could put your life savings into an investment where, if the idea works out it’s going to produce a thousand times return. But guess what? There’s only a one in two hundred chance of this particular idea working out.”

That’s more like gambling rather than investment.

So this is the problem that we decided to solve. The idea is to transition investment leadership from profit-driven investors to a formula where the millions of consumers who want the cure, can invest in companies based on their desire for that research to move forward, even though it’s unlikely to make profits or even to preserve principal.

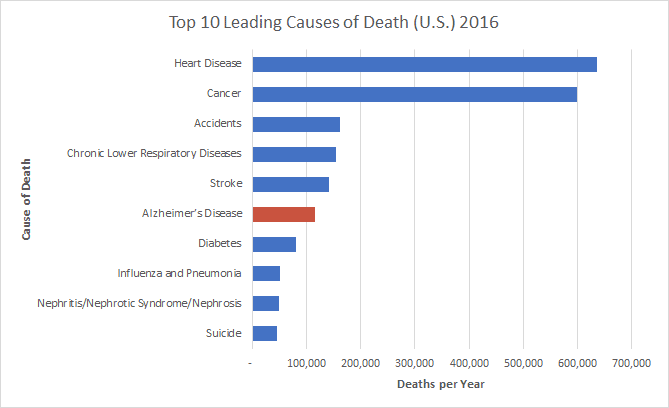

Why did you decide to focus on Alzheimer’s disease?

The reason we chose Alzheimer’s is that it is the only disease of the top ten causes of death that has absolutely no cure or preventative treatment. The system for investing in Alzheimer’s research is particularly broken simply because, in the past 15 years, there have been no drugs approved.

From a financial risk management perspective, investing in Alzheimer’s research is not a good investment. But at the same time, there’s tremendous innovation on the basic research side, and many, many leads that should be followed, and lives that need to be saved.

How does InvestAcure choose which companies to invest in?

The idea is that we are investing based on science, not just potential returns.

The research that’s currently not getting done is the riskiest part: early-stage drug discovery, and phase 1 and 2 clinical trials. We select promising research to invest in based on our scientific advisory board.

Our board includes people like Pierre Tariot, who is the Director of the Banner Alzheimer’s Institute and has written over 350 scientific papers, some of which have led to FDA approval of Alzheimer’s treatments.

Similarly, we have Ken Abramowitz, who has recently come on as our Chief Investment Officer. Ken is one of the 15 top pharmaceutical analysts in the world.

How can users keep track of their investments?

On the platform, each user will be able to see all the stocks in their portfolio. You’ll see the impact that you’re making, and also the collective impact that we’re all making together. They will get constant updates on how the trials are doing and what we’re learning from each trial, so they’ll feel like they’re owner-partners in the process.

Remember, it’s not a donation, it’s an investment. You should not be investing your life savings and money you need for the future in clinical stage pharmaceuticals. That is not a very smart investment.

Spare change is a logical amount to invest that you’re not going to miss. So we do have to set limits in terms of how much individual investor should invest.

How does InvestAcure itself make money?

We are a standard RIA model, which means that we charge a management fee of $2 a month for accounts under $5,000, or 1% of funds under management for accounts over $5,000.

What stage of development is InvestAcure currently in, and what has been the response so far?

We launched the company a year ago. Right now we are developing the app, and we hope to launch in the next six to eight months.

One of the challenges of what we’re doing is that the idea is quite complicated. To explain to the average consumer the dynamics of investment and why it’s not working, it’s very complicated.

The messaging that does resonate is the message of, “Imagine a world where drug companies are owned by millions of spare change investors committed to curing Alzheimer’s.”

Consumers may not know exactly how drug discovery works, but they know that ultimately, every drug that we have is developed by some company, and they tremendously mistrust the companies. So the idea of people committed to a cure owning drug companies is something that’s very appealing to consumers and channels that emotion and distrust in companies in a positive way.

If you are not happy with the way the pharmaceutical industry works, companies are owned by shareholders. Let’s all own those companies together.

What do you see as the long-term impact of InvestAcure?

The potential of this is huge. If just 1.5% of the 70 million Americans who have a relative with Alzheimer’s become spare change investors, that will mean $600 million a year in investment. That will be a game-changer for those early-stage companies.

Considering that a phase 2 study costs around $20 million, we can support a lot of phase 2 studies based on that initial investment.

There’s going to be a lot of consumer education that needs to happen. The reason we are launching is because people need to be educated about investing in drug companies if they want to see the diseases that plague us and threaten our lives and destroy our families, cured.

We don’t want to build this on altruism. This is not a feel-good way to make the world a better place.

The fact is that, if we live to old age, we have a 47% chance of developing Alzheimer’s.

And the fact is that, if you and all of your friends will invest spare change in these companies, and allow countless trials to get done, chances are pretty good that, 20-25 years from now, when you begin to show signs of Alzheimer’s just like your father or grandfather did, or grandmother, there will be a cure.

So, it’s about saving your own life, not just making the world a better place. The reason you should do it is not for somebody else. You should do it for yourself.